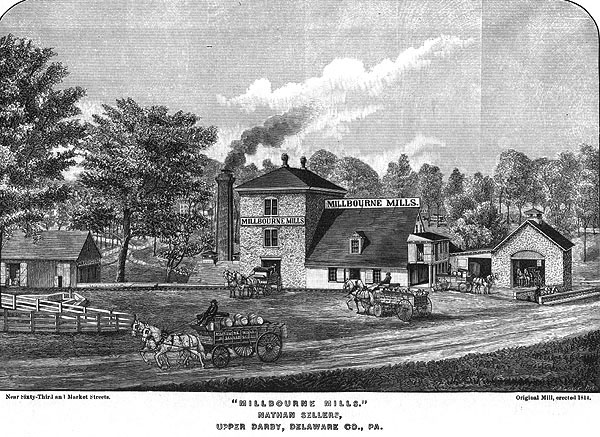

The Milbourne Mills were torn down about 1912 after closing in 1907 and the site became a Sears Store at 63rd and Market Sts. The Sears was torn down after it closed in 1988 and the site is now empty. The above print is from 1875.

Note: 2019 is the year of the mill in Delco. Later this year there will be talks, tours etc. about mills in the area and their history. The Milbourne Mills were owned by the Sellers Family for over 150 years. Mills began closing rapidly from the late 1890's thru the 1930's as eastern Delaware County went from rural to urban in rapid fashion.

FAMOUS MILBOURNE MILLS COMPANY GOES TO THE WALL

Upper

Darby Concern Fails after a Prosperous Business Career of One Hundred and Fifty

Years and the Collapse a Surprise to Owner and Creditors – Court Asked to Appoint

a Receiver

The

Milbourne Mills Company, whose bit plant is located on Cobb’s Creek in Upper

Darby Township, has encountered financial disaster.

James W.

Bayard, as counsel for the estates of William Sellers, John Sellers and other

creditors of the company, filed a petition in bankruptcy in the United States District

Court yesterday. Application will be

made for the appointment of a receiver today.

This old

flour milling concern, which is going to the wall at the instance of those most

closely associated with it, has a remarkable history. The plant stands on ground which William Penn

conveyed to Samuel Sellers in 1682. It

was in 1757 that the business began, with the erection of a small grist mill by

John Sellers, a grandson of Samuel.

Since then

the Milbourne Mills have continued an unbroken career until they were closed

last Monday night. In 1885 the business

was incorporated as the Milbourne Mills Company. The capitalization is nominal, only

$136,000. William and John Sellers

estimate the plant to be worth $500,000.

It has a capacity of 1,500 barrels of flour a day.

That the

affairs of the Milbourne Mills Company were in bad shape was a complete

surprise to the owners and chief creditors.

The facts upon which the board of directors acted at a special meeting

held yesterday was not made public property until Monday.

ACTED TO

PROTECT INTERESTS – When John G. Johnson, who is an executor of the estate of

John Sellers, was told the conditions, he agreed that prompt action should be

taken to protect all interests concerned.

It was first intended to file an equity bill in Common Pleas Court, but

yesterday the plan was changed.

In the

petition filed in the United States District Court, it is stated that the

liabilities of the Milbourne Mills Company, other than miscellaneous accounts,

aggregate $751,000, as follows:

Unsecured loan from the estate of John Sellers, $280,000; similar loan

from the estate of William Sellers, $140,000; loans from financial institutions

on demand notes, some of them with collateral security, $161,000; loans from

financial institutions on paper discounted, $170,000.

It is explained

that the Sellers’ investment in the Milbourne Mills Company is entirely apart

from that in William Sellers & Co., Inc., and in the Midvale Steel Company,

so that neither of these great concerns is in any way involved in the Milbourne

trouble.

Accompanying

this unexpected action there is much bad feeling against Richard S. Dewees,

who, as president of the company since January, 1902, virtually has conducted

the business alone.

It

appears that for fifteen years at least there had been no auditing of the

company’s books until a few days ago, when Meyer Goldsmith, a public

accountant, was engaged by the board of directors. It was upon his statement, that the board

passed the resolution that the company could not pay its debts. The quick assets are placed at $175,

000. This does not include the value of

the plant.

It is

understood that the application to be made today for appointment of a receiver

will allege “gross mismanagement” by the president “misrepresentation as to the

value of stocks” and impropriety in entering into contracts for 44,700 barrels

of flour”.

Since

these contracts were made the price of wheat has advanced from 20 to 25 cents a

bushel. As an excuse for the failure, it

is intimated that the Pennsylvania has discriminated against the Milbourne, but

it will be remembered that the company enjoyed and still has the

milling-in-transit privilege, which, the railroad withheld from the Atlantic

Flour Mills Company, which consequently never went into operation.

When

seen last night at his Haverford home, just after the Unites States deputy

marshal had served the papers, R.S. Dewees, president of the company, was

greatly depressed and very nervous.

“I do

not want to say anything about the matter now, nor until after advising with

counsel, so I ask to be excused,” said Mr. Dewees.

“It is

charged, Mr. Dewees, that your management of the Milbourne Mills has been bad.”

“All I

can say is that I have done the best I could under very difficult and highly

discouraging conditions.”

“As a

reason for the present unfortunate result, Mr. Dewees, it is said, that the

Pennsylvania has discriminated against the Milbourne Mills.”

“Well, there

is nothing I want to say upon that matter at this time. Later something may develop.”

“I

remember, Mr. Dewees, that as a witness before the Interstate Commerce

Commission in the differential proceeding about three years ago, you said in

exporting flour the Milbourne Mills had trouble in doing so from Philadelphia,

because of the high switching charge to the water front, and that for this

reason you exported through New York and there had to meet sharp competition

from the Northwest.”

“You

have about the right understanding of our position in that respect. I need not talk more about it now.”

“While

not directly charged, it is broadly intimated, Mr. Dewees, that some things

appear not to be entirely straight in the Milbourne management.”

“Do they

say that? Then there is all the greater

reason why I should say nothing now, but only at the proper time, and then with

advice of counsel.”

“Did the

petition in bankruptcy surprise you, Mr. Dewees?”

“Not

after the feeling that has been shown in the last few days. This action was uncalled for. There was a way out of it. I will appear to be represented at the

hearing in court tomorrow.”

BEARS

EXCELLENT REPUTATION – A member of the Society of Friends and long a respected

member of the Commercial Exchange, where he has always enjoyed the highest

reputation, Mr. Dewees’ lives in simple and inexpensive style. His friends spurn the idea that his

management is not strictly honest.

Other

officers of the Milbourne Mills Company are:

Howard Sellers, vice president; Frank K. Miller, treasurer, and A.P.

Husband, secretary. The directors are

R.S. Dewees, Frank K. Miller and representing the controlling Sellers’

interest, Howard Sellers, William F. Sellers, Charles B. Dunn, A. Merritt,

Taylor and George A. Fairlamb.

The

Milbourne Mills Company ranks as fifth in the Association of Centenary Firms

and Corporations of the United States.

Francis Perot’s Sons Malting Company of Philadelphia, founded in 1687,

heads the list.

No comments:

Post a Comment